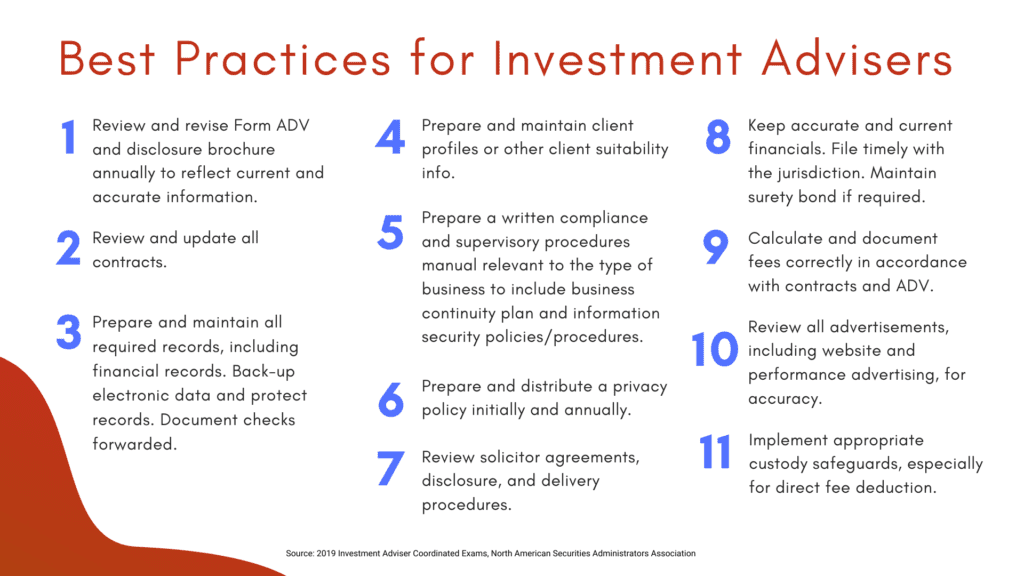

If you’re a legally registered investment adviser (IA), then you know the end of the year means concentrating on regulatory audits. The North American Securities Administrators Association (NASAA) 2019 IA Coordinated Exams overview is an excellent resource for helpful tips to avoid the most common deficiencies as well as a how-to implement best practices for IAs. Let’s take a look at the top shortcomings, or you can go directly to the best practices.

Books & Records

Based on the report, the most common issue noted was Books & Records violations. Within Books & Records, written agreements and financials were the two most common violations. If you haven’t familiarized yourself specifically with these requirements, the Legal Information Institute provides a comprehensive overview of 17 CFR § 275.204-2 – Books and records to be maintained by investment advisers of the Rules and Regulations of the Investment Advisers Act of 1940. The language will be the same for state-registered advisers as the states adopted the same or a very similar version of that language.

Pro Tip: Remember, when it comes to agreements, it isn’t fully executed until signed and dated by both parties. It should be a standard procedure that the adviser obtains and maintains a fully executed agreement for each client and provides the client with a copy of the fully executed agreement.

While the language doesn’t guide IAs on how often financials have to be updated, we recommend that if you’re a larger adviser with significant cash flow, maintain financials monthly. For medium to small size advisers, we recommend quarterly updates.

Registration Violations

The second most cited issue during exams was registration violations. The two common deficiencies in regard to registration were inconsistencies with Form ADV Part 1 and 2, and Form ADV services provided. When creating, updating, and maintaining Part 1 and 2, it’s imperative to follow the instructions to ensure each section properly discloses all required information.

Resource Tip: Here are the instructions to Form ADV Part 1 and Form ADV Part 2.

Revisit the instructions each time an amendment is made to ensure it’s completed based on the most current regulatory requirements.

Contracts

The third most common issue noted in the report concerns advisory agreements or contracts. A common problem noted was that the description of services and fees disclosed in the agreement doesn’t match the ADV Part 2. Please remember that the ADV must provide a fee schedule, meaning that you must disclose:

- The fee rate.

- The frequency in which fees are charged and billed.

- What balance is used in calculating the fee.

- The formula for calculating the fee.

The fee schedule described in the advisory agreement must match the description disclosed within the ADV Part 2. This also goes for the description of services. The agreement needs to provide a description of all services offered, and those services should match what’s disclosed within the ADV Part 2.

Cybersecurity

Tech in the financial services industry isn’t going anywhere and is likely to have an increasing role, making it easier for the bad guys to steal money and identities. Although it ranked fourth on the list, cybersecurity is an area in which every firm should focus.

Compliance is an expense that may not provide an outright return. Still, it’s essential to keep on top of your compliance program and be familiar with the rules and regulations under which you operate. If you have questions, please reach out to the Red Oak team.

About Red Oak Compliance Solutions

Red Oak Compliance Solutions is a leading provider of intelligent compliance software, offering a range of AI-powered solutions designed to help firms of all sizes successfully navigate the increasingly complex regulatory landscape. Our suite of 17(a)-4/WORM compliant features offer risk minimization, cost reduction, and process optimization capabilities with features that are designed to evolve with our client’s needs. Our flagship advertising review software enables firms to deliver compliant content to the market with confidence, faster. Our Disclosure Management and Intelligence solution simplifies the management of disclosures, while our Registration Management solution automates and streamlines the licensing and registration process, further enhancing your internal processes.