FINRA is requesting comments on a proposed new rule for outside business activities and private securities transactions of registered persons. This proposed rule would replace FINRA Rule 3270 (Outside Business Activities (OBAs) of Registered Persons) and FINRA Rule 3280 (Private Securities Transactions of an Associated Person). It is intended to reduce unnecessary burdens while also strengthen investor protections relating to these activities.

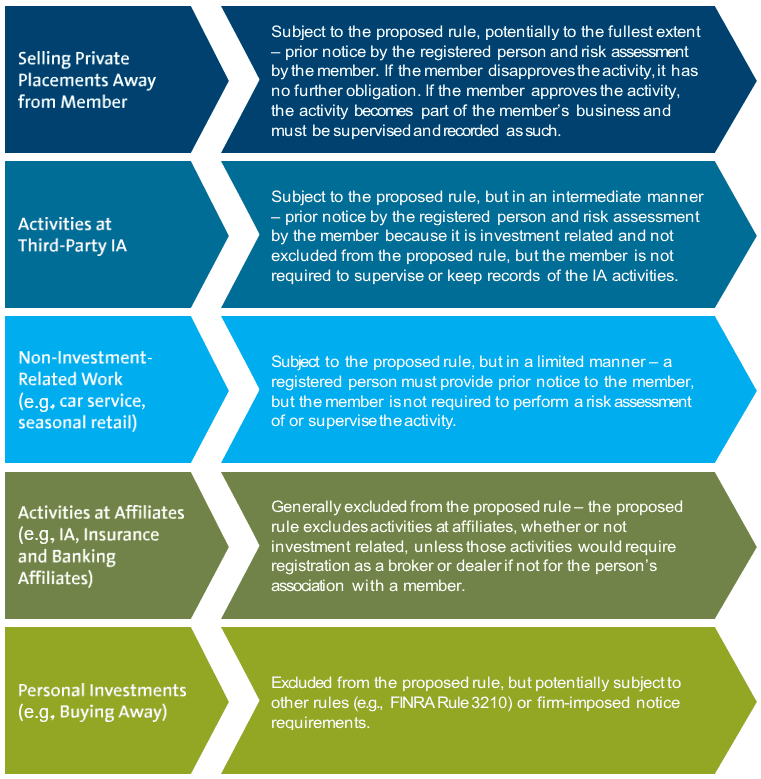

The following summarizes core concepts of the proposed rule, which are discussed in greater detail in the Notice:

The proposed new rule is in response to the belief of stakeholders that the scope of activities subject to OBA rule (Rule 3270), should be narrowed. Yet, a number of these stakeholders also believed that notice of private securities transactions under Rule 3280 should not be narrowed.

If you are interested in commenting on the proposal you have until April 27, 2018. Comments can be sent by email to pubcom@finra.org.

About Red Oak Compliance Solutions

Red Oak Compliance Solutions is a leading provider of intelligent compliance software, offering a range of AI-powered solutions designed to help firms of all sizes successfully navigate the increasingly complex regulatory landscape. Our suite of 17(a)-4/WORM compliant features offer risk minimization, cost reduction, and process optimization capabilities with features that are designed to evolve with our client’s needs. Our flagship advertising review software enables firms to deliver compliant content to the market with confidence, faster. Our Disclosure Management and Intelligence solution simplifies the management of disclosures, while our Registration Management solution automates and streamlines the licensing and registration process, further enhancing your internal processes.